Key Points

- The Australian economy grew solidly over the last year.

- While recession remains very unlikely, the combination of a slowing housing cycle, constraints on consumer spending and still subdued business investment will likely see growth slow to around 2.5 – 3%.

- As a result, spare capacity is likely to remain significant, keeping wages growth and inflation low.

- We don’t expect the RBA to start raising rates until late 2020 at the earliest and the risk remains significant that the next move could be a cut.

Introduction

For years now, many have told us that Australia is heading for an imminent recession. By contrast official forecasts have long been looking for several years of above trend growth. In the event neither has happened and we don’t see them happening anytime soon. Against this backdrop there are five things you should know about the Australian economy.

First – the economy grew solidly over the last year

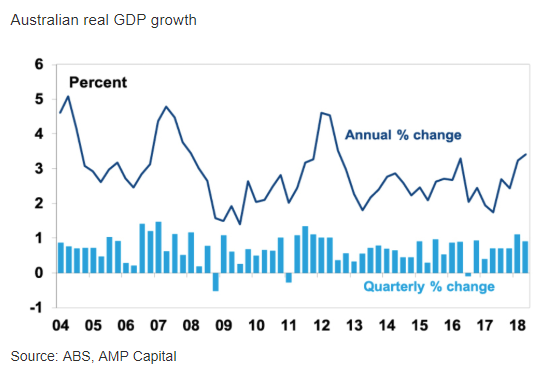

After several years of muddling along the Australian economy actually perked up over the last year with GDP growing a surprisingly strong 3.4% year on year, its fastest since 2012.

That growth has been able to range between just below 2% and just above 3% over the last six years, despite a large drag on growth from the fall back in mining investment, is actually pretty good. But it’s below the norm for Australia, which has averaged around 3% GDP growth per annum over the very long term. It should also be remembered that strong population growth has been one of the reasons for the relative resilience of Australia’s economy, but over the last year per capita GDP growth at 1.8% has been running below that in the US and in line with that in Europe.

Second – growth is likely to slow a bit from here

While economic growth averaged a strong 1% quarterly pace in the first half of the year it’s likely to slow going forward:

- The housing construction cycle is turning down as approvals trend down and the cranes come down. Falling alterations and additions won’t help.

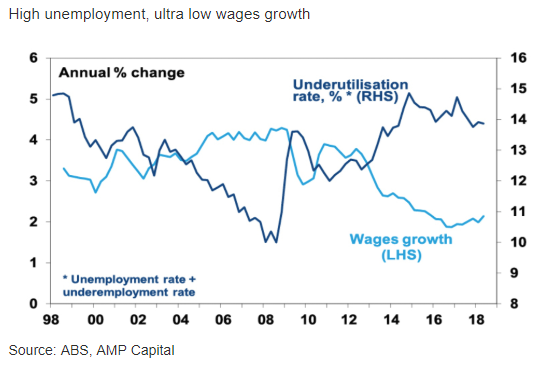

- Growth in consumer spending is likely to slow given weak wages growth, high levels of underemployment and slowing wealth gains as home prices fall. With falling home prices its unlikely that households will be prepared to keep running down the household savings rate – which is now at a 10 year low of just 1% – to make up for weak income growth.

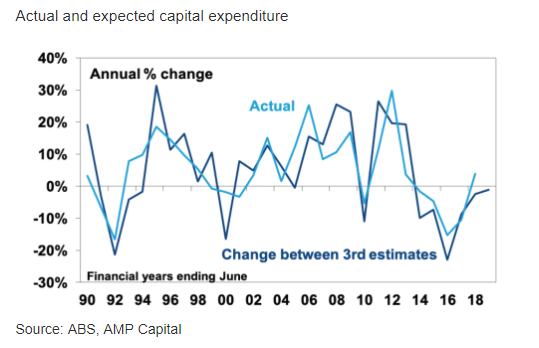

- Business investment plans for the current financial year are still subdued pointing to roughly flat investment (if plans for this year are compared with those made a year ago) and political uncertainty could start to weigh ahead of a potential change in government.

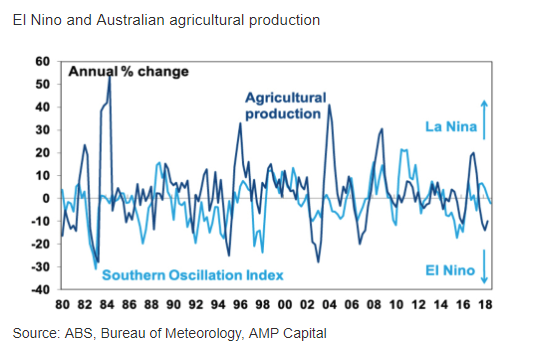

- Drought could knock 0.5 percentage points off economic growth this year.

While agricultural production as a share of GDP is now just 2.5%, a 20% slump in farm production as seen in past droughts would still knock 0.5% off economic growth. If it turns into an El Nino phenomenon it could be worse.

Third – but it’s not going into recession

Despite these drags, recession will continue to be avoided just as it has been over the past 27 years:

- Over the past five years or so the slump in mining investment back to more normal levels has knocked around 1.5% per annum from GDP growth. However, mining investment is no longer 7% of the economy and it’s near the bottom so its drag on GDP growth is approaching zero.

- Public infrastructure spending is rising and has further to go.

- Net exports are likely to add to growth as the completion of resources projects boots resources export volumes, although a US/China trade war is a threat here.

- Profits for listed companies are rising in contrast to the 2014-2016 period. This is a positive for investment. While profit growth has slowed from 17% in 2016-2017 to around 8% it’s positive and 77% of companies in the recent reporting season (the highest since the GFC) have seen rising profits with 86% of companies raising or maintaining their dividends indicating confidence in the outlook.

So while housing construction will slow and consumer spending is constrained, a lessening drag from mining investment and slightly stronger non-mining investment along with solid export growth provide an offset and are expected to see growth between 2.5-3% going forward. Down from over the last year and slower than the RBA expects, but stronger than may doomsters see.

Fourth – spare capacity will remain for a while yet

With the economy’s potential (or sustainable ) growth rate running around 2.75% and actual economic growth likely to run around this spare capacity in the economy will be with us for a while yet. To use it up we really need a long period of above trend economic growth, but this looks unlikely. Spare capacity remains most obvious in the labour market where the underutilisation rate remains historically high at near 14%. With it likely to remain high for some time to come it’s hard to see much acceleration in wage growth or inflation in the economy.

Fifth – which means RBA rate hikes are a long way off

The RBA’s forecasts for continuing solid economic growth and a gradual rise in underlying inflation argue against a rate cut and support the case for an eventual hike. But our more constrained view on growth implying lower for longer wages growth and home prices, tightening bank lending standards and the drought indicate a rate hike is unlikely to be justified any time soon. The next move in rates is probably still up but not until second half 2020 at the earliest and there is a risk that the next move will actually be down if falling home prices pose a significant threat to consumer spending and inflation starts falling again.

Implications for investors

There are several implication s for Australian investors.

First, continuing growth should provide support for reasonable returns for Australian growth assets.

Second, bank deposits are likely to provide poor returns for investors for a while yet.

Third, while Australian shares are great for income, global shares are likely to remain out-performers for capital growth.

Finally, the outlook remains for a further fall in the $A. With the RBA comfortably on hold and the Fed raising rates every three months (with the next move coming this month), the interest rate gap between Australia and the US will go further into negative territory making it even more attractive to park money in the US and not Australia which will drag the $A down. Threats to global growth from a trade war and problems in emerging countries with also weigh on the $A.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist – AMP Capital

Important Note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.